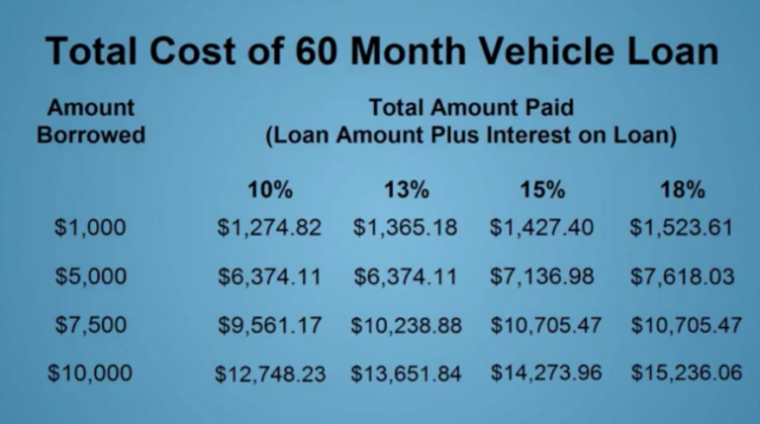

Buying a new or used car can be expensive, which is why saving up is always advisable. However, should you end up needing a fresh vehicle in the very near future and don’t have time to save, or simply want to spread the costs out monthly, then car financing could be a good idea. There are two main choices for financing your next car and a variety of further options within each method, all of which are detailed below.

Dealer Finance Options

If you buy a new or used car through a dealer, there are three types of finance they are likely to offer. Each one has its own pros and cons to suit different situations.

Hire Purchase

With Hire Purchase (HP) you need to pay a deposit (usually about 10%) and then repay the balance owed in monthly installments plus interest, over the agreed loan period. It is basically a secured loan, with the security the car you’re buying. This does mean that if you miss any payments then it can be repossessed, and you only own the vehicle once the last payment has been made. However, you can get a new car with a low deposit fairly easily.

Personal Contract Purchase

Similar to HP, Personal Contract Purchase (PCP) involves putting down a deposit and making monthly payments. The difference is that the amount you’re paying includes cover for the amount of depreciation of the vehicle. Therefore, to own the car outright you’ll need to make a large one-off payment at the end of the payment period or can opt to swap for a different car and take out a new contract.

Personal Leasing

There is no option to buy the car at the end of a personal lease, which does offer low monthly payments. It also makes switching to a different new car a lot easier and you can get a good deal for you, with the price based on the model and mileage limitations. Sometimes servicing will be included, and you may need to pay a three-month deposit at the start.

Source: Aceable Drivers Ed

Source: Aceable Drivers Ed

Personal Financing

You can fund your new or used car independently in a few simple ways too:

- Cash: If you’ve managed to save up enough to cover the full costs then buying outright can be advisable.

- Credit card: Just like any large purchase, it’s possible to buy on your credit card which can offer greater protection. Check the APR though as it can be high and not all dealers will accept credit card payment.

- Personal loan: You can take out a personal loan at PaydayAvailable.com to cover the costs of a car or just the initial deposit. The better your credit rating the better loan terms you will receive.

There are many different car financing options available, so choose the one that appeals and best meets your needs.

You may also like

What Changes When Glp-1s Become Pills

Fibermaxxing Explained: Hype, Help, and How-to

Why Whimsy Sparks Joy in a Burned-out World

Digital Detox, Minus the Retreat (and Hype)

Why Tiktok's "Becoming Chinese" Feels So Good